defer capital gains taxes indefinitely

Wait at least one year before selling a property. The QOF then funnels your gains and those of others into federally designated lower-income areas.

Taxation For Capital Gains Capital Gains Reserve For Future Proceeds

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

. Know More You should consider a 1031 exchange if. That presumably means that if delivery is deferred until after her death no capital gains tax would be paid on the entire appreciation in value of her shares. For realized but untaxed capital gains short- or long-term from the stock sale.

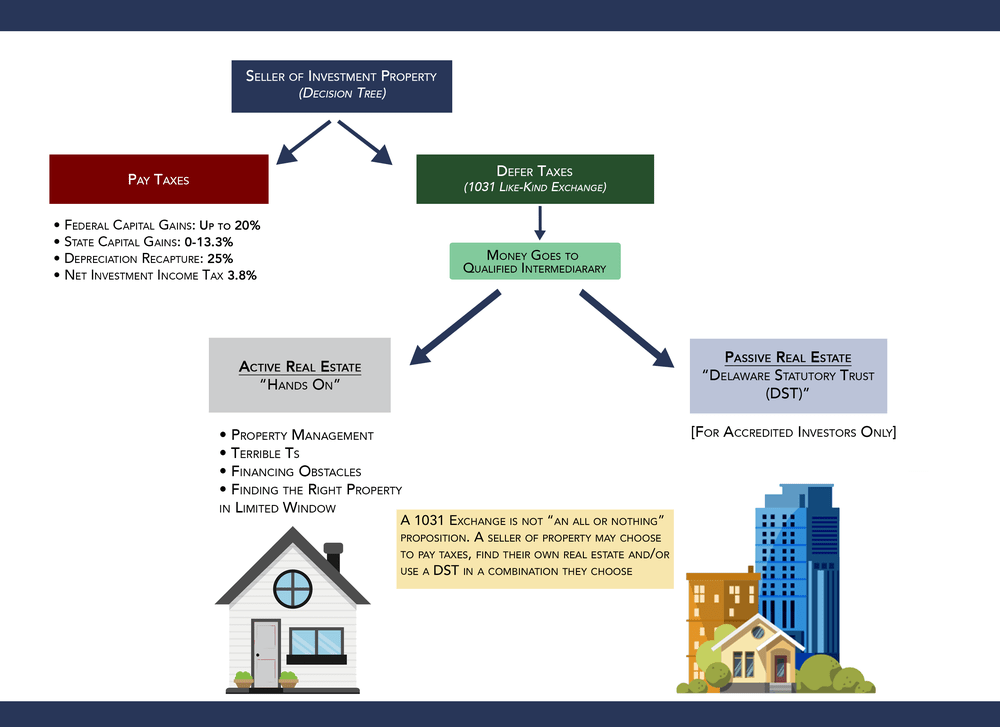

The DST defers capital gains and other taxation on the sale. The short answer is. The DST bridges the gap between selling the property and sheltering the capital gains from it.

6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. Its entirely possible to roll over the gain from your investment swaps for many years and avoid paying capital gains tax until a property is finally sold.

Best Tax Relief Brands. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

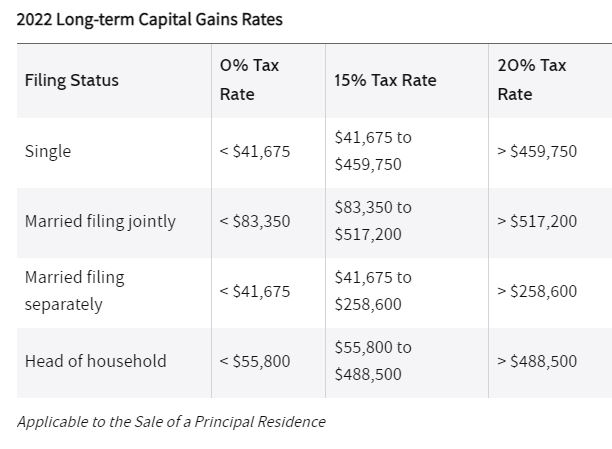

Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert. Individuals can exclude up to 250000 of capital gains from the sale of their primary residence or 500000 for a married couple. In simplest terms a 1031 exchange allows you to swap rather than sell thereby deferring capital gains taxes indefinitely.

1 After accounting for state and Medicare taxes this rate can get up to 30-35 of your gain or in this. Invest in Silicon Valley Real Estate. The Deferred Sales Trust.

Not only can you delay paying taxes on capital gains depending on how long your gain has been held in the fund your basis can increase by up to 15. Those not willing to keep investing in property ready to cash out in other. Ad Explore Our Recommendations for 2022s Top Tax Relief Companies.

This allows them to receive monthly payments for the interest accrued on their investments. There is a way to accomplish the sale of an asset you own that has grown in value so that you not only defer your capital gains tax for many years but you also exit with cash equivalent to most. Those willing to reinvest and buy more property can defer the capital gains tax with a 1031 exchange.

Click Now Compare 2022s 10 Best Tax Relief Companies. Invest in Silicon Valley Real Estate. Furthermore if you keep.

Ad 4 Simple Steps to Settle Your Debt. Many clients choose to indefinitely defer their capital gains taxes by investing the entire principle. In other words the best way to use the 1031 exchange is to always keep the equity invested by structuring 1031.

Sell Commercial Property Postpone Paying Taxes Indefinitely Using Our Unique Proprietary Process 1031 Exchange Avoid Capital Gains Tax Tax Published May 12 2022. Leverage the IRS Primary Residence. Families who stay in the same home for.

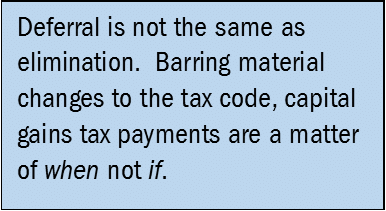

Keep in mind however. The federal tax rate on a long-term capital gain of 500000 is 20 or 100000. In addition to helping lower-income communities the process means you can defer.

The tax on those capital gains is deferred until the end of 2026 or earlier should you sell the. Get a Free Consultation. Always defer the income taxes.

Ad Read this guide to learn ways to avoid running out of money in retirement. If you have a 500000 portfolio get this must-read guide by Fisher Investments. Her heirs will not pay income tax.

Deferred Sales Trust Max Cap Financial

How To Avoid Capital Gains Tax On Your Investments Investor Junkie

Capital Gains Full Report Tax Policy Center

Income Tax Deferral Strategies For Real Estate Investors

Commentary How Californians Can Utilize Dsts To Avoid Capital Gains Tax And Diversify Their Portfolios California Business Journal

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Capital Gains Tax In The United States Wikiwand

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Tax Deferral Capital Gains Tax Exemptions

High Class Problem Large Realized Capital Gains Montag Wealth

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Minimizing The Capital Gains Tax On Home Sale Bubbleinfo Com

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)